Ahoy, Linea DeFi Voyagers!

We want to introduce you to XFAI, a next-generation Decentralized Exchange (DEX) on Linea. XFAI aims to revolutionize the Decentralized Finance (DeFi) landscape. XFAI is not just another Uniswap fork, it’s a unique architecture with a brand-new set of features.

XFAI is creating a reputation within the Linea network for having the lowest gas fees of any DEX on Linea. They have attracted over $2M in total value locked (TVL), comprising over 6% of Linea’s total DeFi TVL. This includes the largest wrapped Bitcoin (wBTC) TVL across the chain.

Traders often choose XFAI for their DeFi swap tasks on Linea, and it seems to be a promising option for users in the liquidity provision wave tasks. XFAI’s concentrated liquidity (and thus removal of token pairs and fragmented liquidity, resulting in concentrated fees for LPs) make it an attractive option for liquidity providers as LPs can earn higher fees per volume capita when using XFAI than other DEXs.

With the overwhelming success of the Linea DeFi Voyage so far, Linea is already positioning itself to be the new home for DeFi.

Introducing XFAI

XFAI is the brainchild of brothers Lum and Taulant Ramabaja, who are renowned and accredited in Artificial Intelligence and decentralized systems. They are supported by core team members hailing from successful projects such as Parity Tech, Polkadot, Synthetix and Ecomi, and backed by AU21 Capital, Rarestone Capital, Moonwhale, Tokenomik, LD Capital, TDeFi, Fission Capital, Kyros Ventures and Vendetta Capital.

XFAI is the mathematically most capital-efficient DEX and aims to be the pinnacle of trading on the Linea ecosystem, boasting an entirely new innovative DEX architecture that:

-

Eliminates fragmented liquidity

-

Enables better swap results with minimal slippage

-

Offers the lowest gas fees for swapping on all of Linea

-

Gives better returns for LPs

-

Ensures better token liquidity for projects

-

Has less set-up costs for projects

-

All while remaining completely permissionless

An Exchange Like No Other: XFAI’s Unique Trading Approach

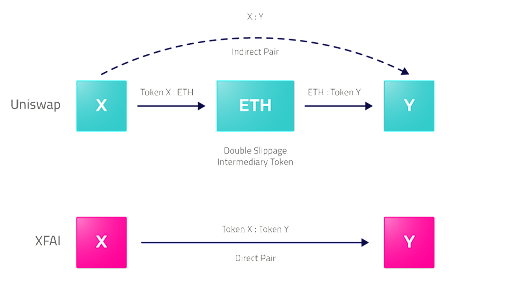

XFAI transforms traditional trading norms by introducing a double-weighted constant market maker design, eliminating the need for multiple token pairs.

When pools are created on XFAI, liquidity providers commit the primary token they want to supply and an equal value of ETH to be used as the balancing weight. The result is that liquidity for each token is concentrated into its own deep pool, resulting in more efficient swaps with minimal slippage, and eliminating liquidity fragmentation into different pools. As a result, XFAI is more performant than exchanges like Uniswap even with a small percentage of the liquidity proportionally, and XFAI’s performance grows exponentially as liquidity increases.

This unique design also introduces several other standout benefits for traders on Linea, the first of these being that every token is directly swappable without the need for intermediaries. For example, if you want to swap between tokens on Uniswap that didn’t have direct pairings then you would have to do two swaps in the background. Compare this with XFAI’s double-weighted model, where every token acts as if they were directly paired with every other token, meaning that direct swaps between tokens can all happen in one smooth motion which minimizes slippage. This culminates in the best trading results possible, meaning more money in your wallet at the end of a swap.

Promising Returns for Liquidity Providers

XFAI's design provides lucrative opportunities for liquidity providers (LPs). Unlike other DEXs where LPs often face negative returns, XFAI's approach allows LPs to earn profits by providing liquidity. Traders earn fees every time a swap occurs with the primary token they have supplied, yielding more impressive returns.

Regarding fees, XFAI excels in the earning opportunities available to LPs, due to the nature of XFAI’s concentrated liquidity pools.

When traders swap tokens on an exchange, LPs earn swap fees. On exchanges like Uniswap, LPs would earn fees for whenever their provided liquidity is traded. However, because liquidity is fragmented into different pools, traders only earn fees when their specific pool is transacted against.

With XFAI it’s a different story. As liquidity for each token sits in one singular deep pool traders earn fees every time a swap happens with the primary token that they have provided, meaning more fees and liquidity provisioning opportunities that result in profit.

Optimal Liquidity Solutions For Linea

In addition to the benefits for traders and LPs, XFAI’s approach offers advantages to projects on Linea. Traditional DEXs require projects to create multiple liquidity pools, fragmenting their liquidity. In contrast, XFAI allows projects to create one liquidity pool, lowering start-up costs, improving liquidity for their token and facilitating more viable swaps.

XFAI also plans to introduce liquidity generation events for projects, allowing projects on Linea to bootstrap communities by offering token rewards for committing funds converted into liquidity, further deepening their token pool and making swaps even more performant.

Linea: The Home for XFAI

XFAI is a Linea-exclusive project and chose Linea as its home chain due to its next-generation scalability and advanced performance as a leading zkEVM. Linea’s wealth of experience, backed by Consensys and championed by MetaMask, makes Linea a clear choice for XFAI. Linea seems set to drive the next wave of adoption through its technical capabilities and rich network of credible partners. XFAI is incredibly excited to work alongside Linea to usher in the mass adoption of DeFi.